RBI GRADE B EXAM

The Reserve Bank of India has invited applications for Direct Recruitment for the Posts of Officers in Grade ‘B’ (Direct Recruit-DR) (On Probation OP) (General/DEPR/DSIM) Cadres

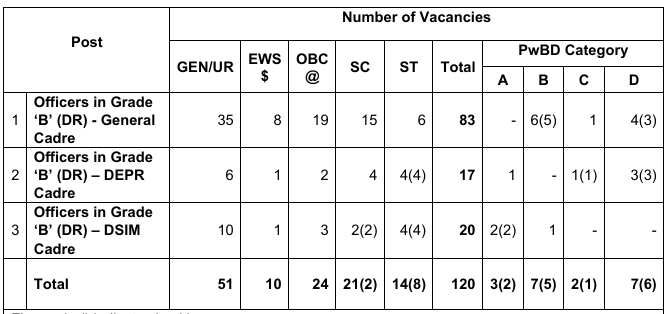

Number of Vacancies :

The total number of vacancies is 120 and the category wise breakup is as below :

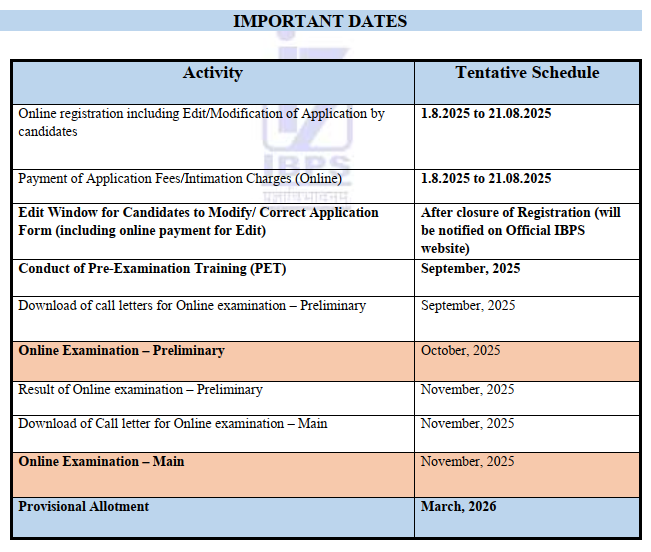

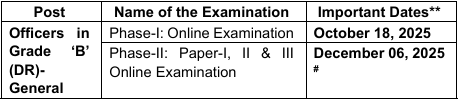

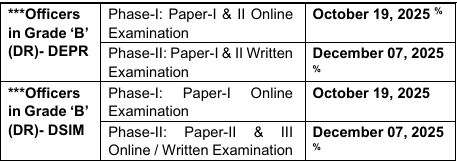

Important Dates :

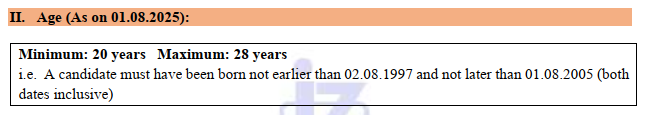

Age Limit ;

A candidate must have attained the age of 21 years and must not have attained the age of 30 years on September 01, 2025 i.e., he/she must have been born not earlier than September 02, 1995 and not later than September 01, 2004.

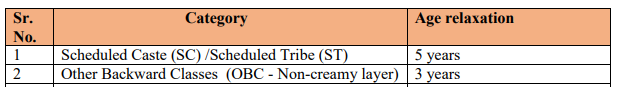

The upper age-limit prescribed above will be relaxed:

- up to a maximum of five years for candidates belonging to a Scheduled Caste or a Scheduled Tribe, if the posts are reserved for them.

- ii) up to a maximum of three years in the case of candidates belonging to Other Backward Classes who are eligible to avail of reservation applicable to such candidates, if the posts are reserved for them

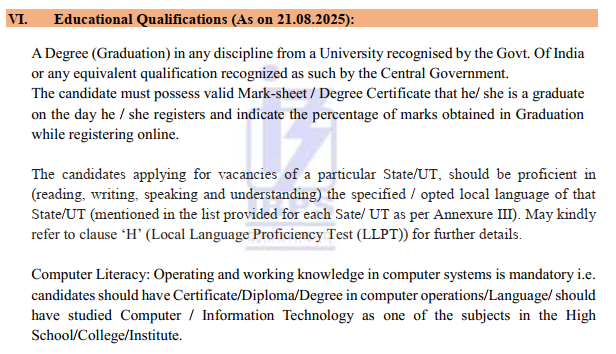

Minimum Educational Qualification :

Officers in Grade ‘B’ (DR) – General :

Graduation in any discipline /Equivalent technical or professional qualification with minimum 60% marks (50 % for SC/ST/PwBD applicants) or Post Graduation in any discipline / Equivalent technical or professional qualification with minimum 55% marks (pass marks for SC/ST/PwBD applicants) in aggregate of all semesters / years.

Officers in Grade ‘B’ (DR) – DEPR :

MA / MSc in Economics or MA / MSc in courses such as Quantitative Economics, Mathematical Economics, Applied Economics, Econometrics, Financial Economics, Business Economics, Agricultural Economics, Industrial Economics, Development Economics and International Economics (where “Economics” is the principal constituent* of the curriculum/ syllabus) with Minimum 55% Marks

(Or)

MA/ MSc in Finance or MA/ MSc in courses such as Quantitative Finance, Mathematical Finance, Quantitative Techniques, International Finance, Business Finance, Banking and Trade Finance, International and Trade Finance, Corporate Finance, Project and Infrastructure Finance, Agri Business Finance (where “Finance” is the principal constituent* of the curriculum / syllabus) , with Minimum 55% Marks

Officers in Grade ‘B’ (DR) – DSIM :

Master’s Degree with a minimum 55% marks in aggregate of all semesters/ years or an equivalent grade/ CGPA in Statistics / Mathematics/ Mathematical Statistics/ Applied Statistics/ Quantitative Economics/ Econometrics/ Informatics or any other related branches of these areas from a recognized Indian/ Foreign University/ Institute approved/ recognized by Government/ UGC/ AICTE

(Or)

Master’s Degree with a minimum 55% marks in aggregate of all semesters/ years or an equivalent grade/ CGPA in Data Science / Artificial Intelligence/ Machine Learning/ Big Data Analytics or any other related branches of these areas from a recognized Indian/ Foreign University/ Institute approved/ recognized by Government/ UGC/ AICTE

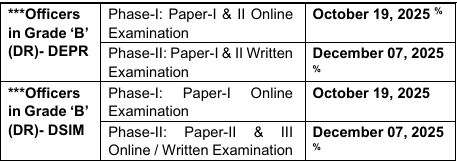

Scheme of Selection :

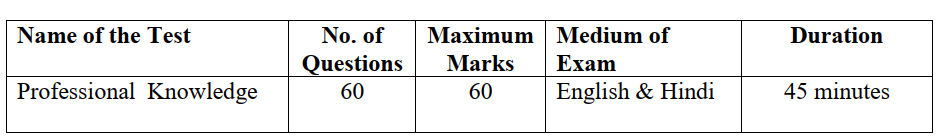

SCHEME OF SELECTION AND SYLLABUS FOR OFFICERS IN GR ‘B’ (DR) – GENERAL :

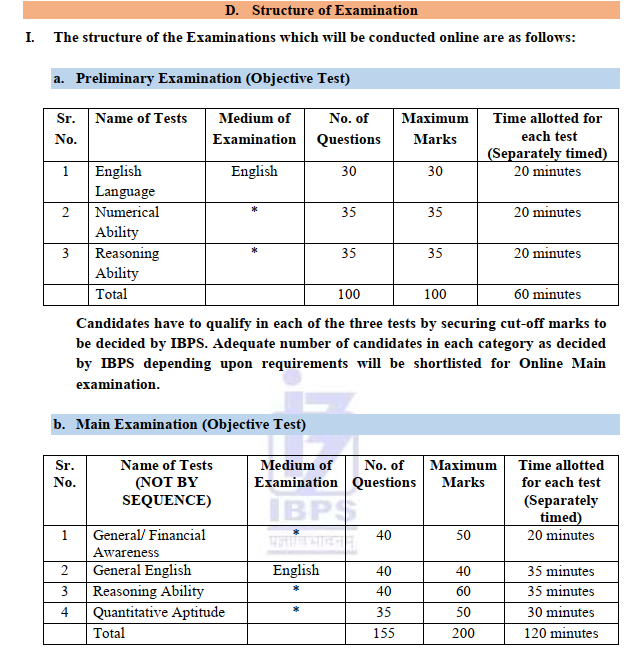

Selection will be through ONLINE examinations and Interview. Examinations will be held in two phases :

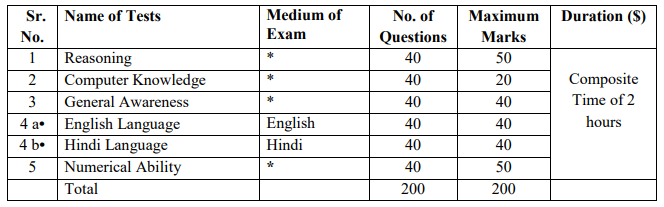

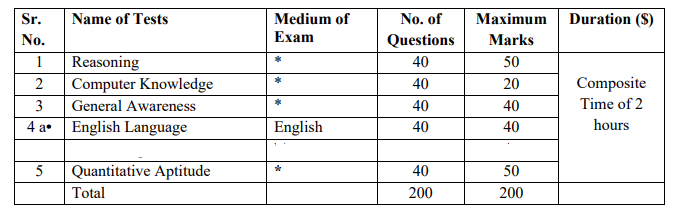

Phase-I Online Examination (Objective Type) : This will comprise a single Paper for 200 marks . The Paper will consist tests of :

- General Awareness

- English Language

- Quantitative Aptitude and

- Reasoning

A total time of 120 minutes will be given for answering. However, separate time will be allotted for each test.

Candidates have to secure minimum marks separately for each test as well as in aggregate, as may be prescribed by the Board. Candidates, who secure minimum marks separately for each Test, as prescribed, will be shortlisted for Phase-II of the examination based on the aggregate marks obtained in Phase-I.

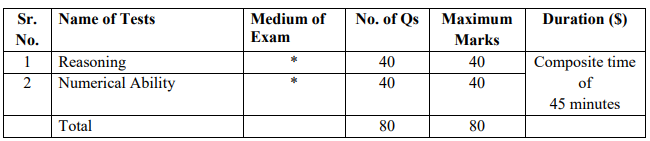

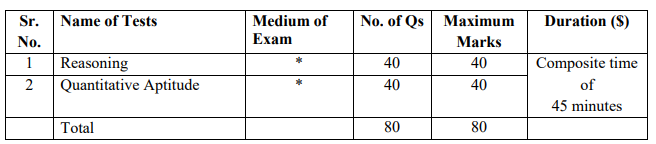

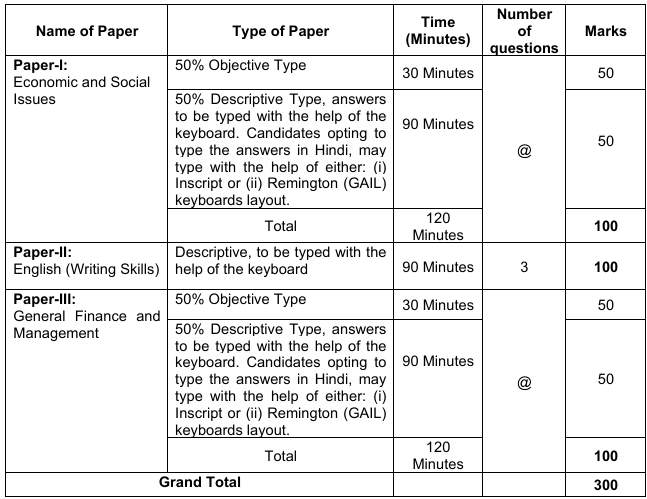

Phase-II Online Examination (Objective Type) :

Phase-II Online Examination will consist of the below three papers

Interview :

Candidates will be shortlisted for the Interview, based on aggregate of marks obtained in Phase-II (Paper-I +Paper-II +Paper-III). The minimum aggregate cut-off marks for being shortlisted for Interview will be decided by the Board in relation to the number of vacancies

Paper-II :

English (Writing Skills) The paper on English shall be framed in a manner to assess the writing skills including expression and understanding of the topic.

Paper -III : General Finance and Management

a) Financial System

1. Structure and Functions of Financial Institutions

2. Functions of Reserve Bank of India

3. Banking System in India – Structure and Developments, Financial Institutions – SIDBI, EXIM Bank, NABARD, NHB, NaBFID etc.

4. Recent Developments in Global Financial System and its impact on Indian Financial System

5. Role of Information Technology in Banking and Finance

6. Non-Banking System

7. Developments in Digital Payments

b) Financial Markets

Primary and Secondary Markets (Forex, Money, Bond, Equity, etc.), functions, instruments, recent developments.

c) General Topics

1. Financial Risk Management

2. Basics of Derivatives

3. Global financial markets and International Banking – broad trends and latest developments

4. Financial Inclusion

5. Alternate source of finance, private and social cost-benefit, Public-Private Partnership 6. Corporate Governance in Banking Sector

7. The Union Budget – Concepts, approach and broad trends

8. Basics of Accounting and Financial Statements – Balance Sheet, Profit and Loss, Cash Flow Statements, Ratio Analysis (such as Debt to Equity, Debtor Days, Creditor Days, Inventory Turnover, Return on Assets, Return on Equity, etc.)

9. Inflation: Definition, trends, estimates, consequences and remedies (control): WPI- CPI – components and trends; striking a balance between inflation and growth through monetary and fiscal policies

#Suggested Reference Material – Finance

• Monetary Theory and Public Policy – Kenneth Kurihara

• Indian Economy – Mishra & Puri

• Economic Growth and Development – Meier and Baldwin

• Financial Management – Prasanna Chandra

• Major financial newspapers

• International Business by Hill and Jain

• RBI Annual Report, Report on Trend and Progress of Banking in India, Report on Currency and Finance etc.

• Economic Survey

• Material sourced from RBI website

d) Management

1. Fundamentals of Management & Organizational Behaviour

Introduction to management; Evolution of management thought: Scientific, Administrative, Human Relations and Systems approach to management; Management functions and Managerial roles; Nudge theory.

Meaning & concept of organizational behaviour; Personality: meaning, factors affecting personality, Big five model of personality; concept of reinforcement; Perception: concept, perceptual errors. Motivation: Concept, importance, Content theories (Maslow’s need theory, Alderfers’ ERG theory, McCllelands’ theory of needs, Herzberg’s two factor theory) & Process theories (Adams equity theory, Vrooms expectancy theory).

Leadership: Concept, Theories (Trait, Behavioural, Contingency, Charismatic, Transactional and Transformational Leadership; Emotional Intelligence: Concept, Importance, Dimensions. Analysis of Interpersonal Relationship: Transactional Analysis, Johari Window; Conflict: Concept, Sources, Types, Management of Conflict; Organizational Change: Concept, Kurt Lewin Theory of Change; Organizational Development (OD): Organisational Change, Strategies for Change, Theories of Planned Change (Lewin’s change model, Action research model, Positive model).

Ethics at the Workplace and Corporate Governance

Meaning of ethics, why ethical problems occur in business. Theories of ethics: Utilitarianism: weighing social cost and benefits, Rights and duties, Justice and fairness, ethics of care, integrating utility, rights, justice and caring, An alternative to moral principles: virtue ethics, teleological theories, egoism theory, relativism theory, Moral issues in business: Ethics in Compliance, Finance, Human Resources, Marketing, etc.

Ethical Principles in Business: introduction, Organization Structure and Ethics, Role of Board of Directors, Best Practices in Ethics Programme, Code of Ethics, Code of Conduct, etc.

Corporate Governance: Factors affecting Corporate Governance; Mechanisms of Corporate Governance.

Communication: Steps in the Communication Process; Communication Channels; Oral versus Written Communication; Verbal versus non-verbal Communication; upward, downward and lateral communication; Barriers to Communication, Role of Information Technology.

#Suggested Reference Material Management

• Stephen P. Robbins & Mary Coulter, Management.

• Stephen P. Robbins and Judge T.A., Vohra, Organisational Behaviour

• Dessler Gary, Warkkey Biju- Human Resource Management

• Decenzo and Robbins- Fundamentals of Human Resource Management

• Velasquez Manuel G: Business Ethics- Concepts and Cases.

• Fernando A.C.: Business Ethics – An Indian Perspective.

• Crane Andrew & Matten Dirk: Business Ethics

• Ghosh B N: Business Ethics & Corporate Governance

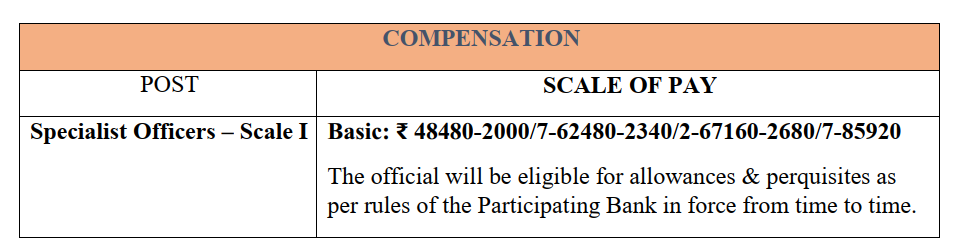

Pay Scale :

Selected candidates will draw a starting basic pay of ₹78,450/-p.m. in the pay scale of ₹78450-4050(9)-114900-EB-4050(2)-123000-4650(4) 141600 (16years) applicable to Officers in Grade ‘B’ and they will also be eligible for Special Allowance, Grade Allowance, Dearness Allowance, Local Compensatory Allowance, Special Grade Allowance, Learning Allowance, House Rent Allowance as per rules in force from time to time. At present, initial monthly gross emoluments (without HRA) are ₹1,50,374/- (approximately).

RBI GRADE B OFFICERS COURSE

RBI Services Board Conducts Grade B Exam for Direct Recruitment of Officers in various Departments of the Reserve Bank of India. Life with RBI is not just another career. It’s a commitment. Commitment to serve the Nation, where your decisions make an impact on the way the economy and the financial sector in the country evolves.